Costco Wholesale Corp (NASDAQ:COST), will be reporting its second-quarter earnings on March 7. Wall Street expects $3.62 in EPS and $59.16 billion in revenues as the company reports after market hours.

Costco’s stock is up by more than 60% in the past year. Since the beginning of 2024, the stock has already delivered returns of over 15% to investors.

Here’s what the stock’s technical setup looks like ahead of the earnings report, and how the stock currently maps against Wall Street estimates.

Costco Stock Technical Setup Ahead Of Q2 Earnings

As the company prepares to report Q2 earnings, Costco stock’s technical setup indicates a strongly bullish trend.

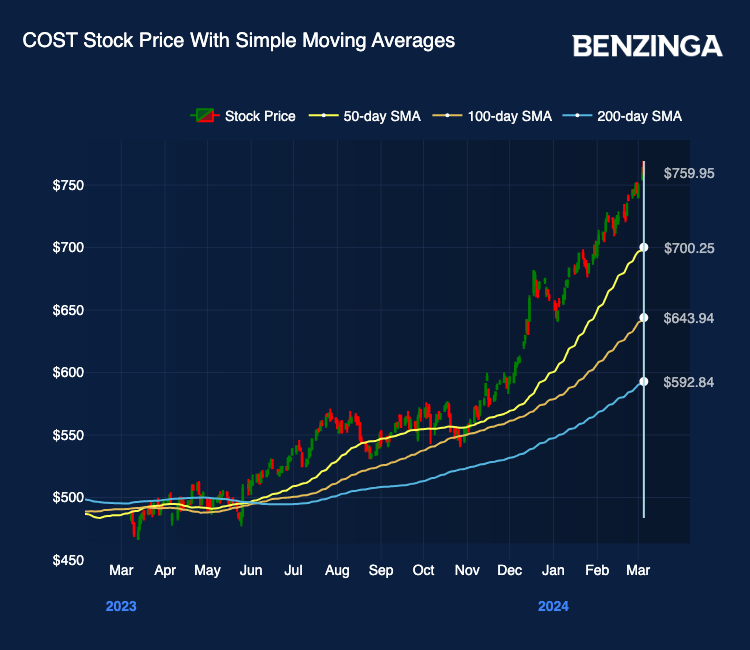

The share price is consistently above its 5, 20, and 50-day exponential moving averages (EMAs) and simple moving averages (SMAs). Despite this positive trend, the presence of selling pressure suggests potential risks of future bearish movements.

Costco’s stock is priced at $769.49, while the 8-day simple moving average is at $748.43, the 20-day SMA at $732.80 and the 50-day SMA at $700.25, indicating bullish momentum. The 200-day SMA of $592.84 confirms the positive outlook at the stock price.

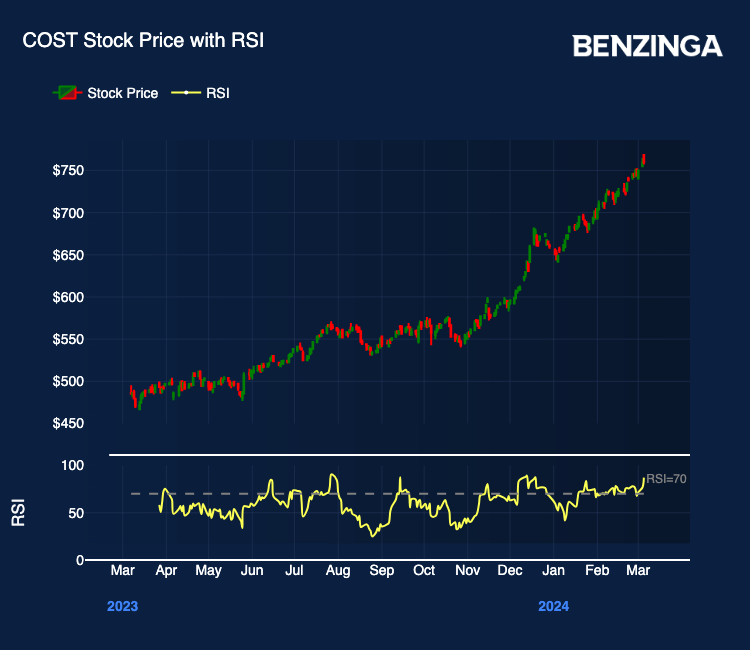

The Moving Average Convergence Divergence (MACD) indicator stands at 15.34, suggesting bullish potential. However, caution is advised as the Relative Strength Index (RSI) is at 87.15, indicating potential overbought conditions. Bollinger Bands (25) and (100) suggest a promising outlook, with respective ranges of $709.75 to $744.41 and $579.02 to $708.88.

While the technical analysis supports a favorable outlook for Costco Wholesale, attention is needed due to the overbought signal from the RSI.

Also Read: Here’s How Much $100 Invested In Costco Wholesale 20 Years Ago Would Be Worth Today

Costco Analysts Consensus Ratings

Ratings & Consensus Estimates: The consensus analyst rating on Costco stock stand at a Buy, with a price target of $618.10.

COST Price Action: Costco stock was trading at $769.49 at the close of trading day on March 6.

Read Next: Evaluating Costco Wholesale Against Peers In Consumer Staples Distribution & Retail Industry

Photo: Shutterstock